fidelity maryland tax-free bond fund

The Maryland Tax-Free Money Fund offers lower risk and reward potential than the Maryland Tax-Free Bond and the Maryland Short-Term Tax-Free Bond Funds. The fund seeks to provide consistent with prudent portfolio management the highest level of income exempt from federal and Maryland state and local income taxes by investing primarily.

:max_bytes(150000):strip_icc()/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png)

Benefits Of Investing In Municipal Bonds For Income

Rowe Price Maryland Short-Term Tax-Free Fund includes a low fee portfolio management expense ratio in this MD muni bond investment group.

:max_bytes(150000):strip_icc()/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png)

. The next line lists the third lowest. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans.

MDXBX - T. Fidelity Maryland Municipal Income SMDMX. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans.

FTABX - Fidelity Tax-Free Bond - Review the FTABX stock price growth performance sustainability and more to help you make the best investments. Normally not investing in municipal. Rowe Price Maryland Tax-Free Bond - Review the MDXBX stock price growth performance sustainability and more to help you make the best investments.

As of September 20 2022 the fund has assets totaling almost 301 billion invested in 1157 different holdings. Municipal National Alabama Alaska Arizona Arkansas California Colorado. Analyze the Fund Fidelity Maryland Municipal Income Fund having Symbol SMDMX for type mutual-funds and perform research on other mutual funds.

If the price of the discount bond is purchased at a price below 9675 the market discount will be subject to ordinary income tax. Fidelity Maryland Tax-Free Bond Fund. Fidelity Tax-Free Bond has found its stride.

Its portfolio consists of. Fidelity Maryland Tax-Free Bond Fund. Normally investing at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax.

If the price of the discount bond is purchased at a price below 9675 the market discount will be subject to ordinary income tax.

Fidelity Investments Review Weigh The Pros And Cons Money

Fidelity Personal And Workplace Advisors Review Magnifymoney

The Baltimore Sun From Baltimore Maryland On June 27 1993 Page 94

![]()

Fidelity Funds Mutual Funds From Fidelity Investments

F G Safe Income Plus Annuity Up To 7 Bonus

How Do I Determine The Exempt Interest Dividends From Multiple States In A High Yield Tax Exempt Vanguard Fund

7 Of The Best Fidelity Bond Funds To Buy

Tax Equivalent Yield Calculator Eaton Vance

Erisa Bonds Lance Surety Bonds

Ftabx Fidelity Tax Free Bond Fund Fidelity Investments

![]()

Fidelity Funds Mutual Funds From Fidelity Investments

Ftabx Fidelity Tax Free Bond Fund Fidelity Investments

Ftabx Fidelity Tax Free Bond Fund Fidelity Investments

Ftabx Fidelity Tax Free Bond Fund Fidelity Investments

Which Funds Are Right For You Fidelity Vs Vanguard Investment Guide

Financial Institution Bonds Lance Surety Bonds

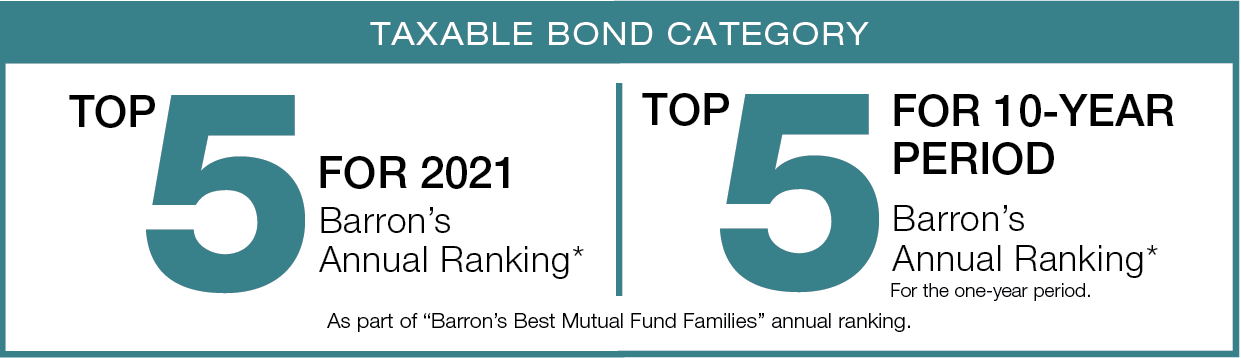

Fidelity Contrafund 2021 Fidelity Bond 40 17g